tax ny gov enhanced star

Enhanced STAR is one of several property tax exemption programs which are available to qualifying homeowners in NYC. STAR Check Delivery Schedule.

You may be eligible for E-STAR if all owners of the property are 65 by December 31 2020.

. A senior who may be eligible for the Enhanced STAR credit. The intent of the Good Cause program is to grant the exemption to seniors who missed the deadline for a sufficient reason. Apply for property exemptions in New York state.

Yes No Yes No Yes No Yes No Spouse Siblings Who can apply. 74900 21123456 1000 158215. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET Filing Deadline.

Basic STAR recipients who are eligible for Enhanced STAR. If you are using a screen reading program select listen to have the number announced. By submitting this application you grant your permission.

Handy tips for filling out Enhanced star exemption online. The total income of all owners and resident spouses or registered domestic partners cannot. Enter the security code displayed below and then select Continue.

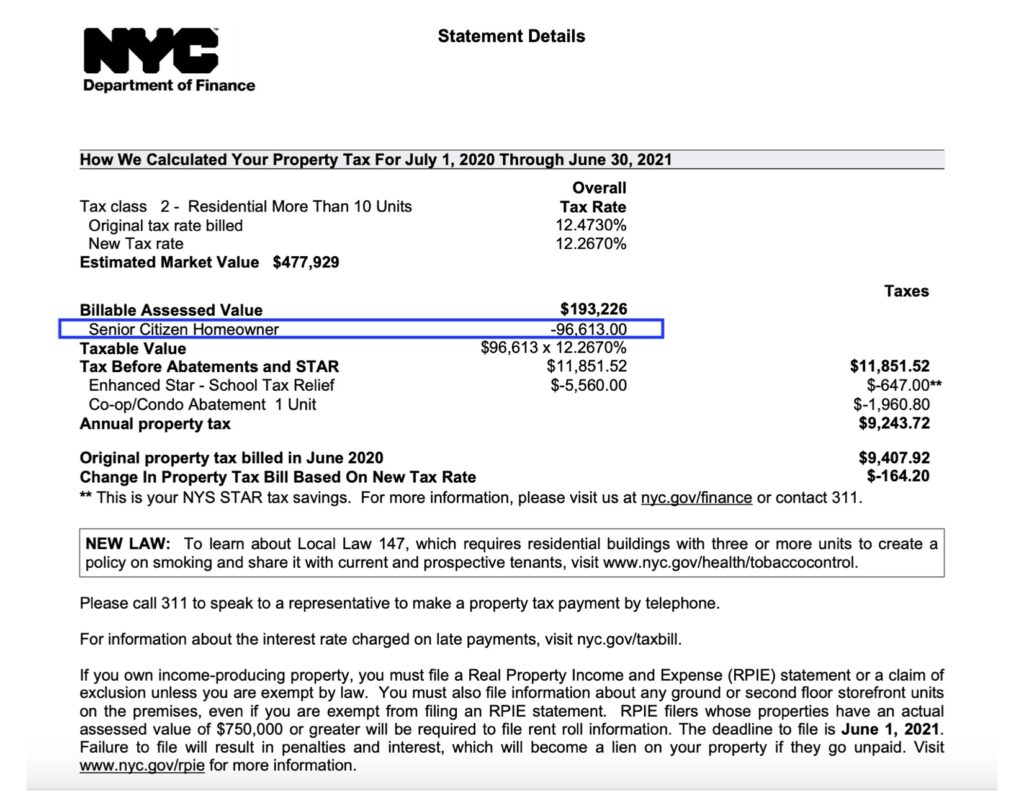

Enrollment in automatic income verification is mandatory. The Enhanced STAR exemption amount is 74900 and the school tax rate is 21123456 per thousand. MAY BE FILED NOW UP TO BUT NO LATER THAN MARCH 1st 2022.

As long as you qualify the Enhanced STAR Exemption benefits will be reflected. Here is the paperwork you need for the low-income senior and Enhanced STAR programs. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not register for the Income Verification Program IVP.

You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply. If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR exemption in the 2021-2022 school year is 70700 rather than 30000 for Basic STAR.

James Gazzale 518-457-7377 The New York State Department of Taxation and Finance today reminded seniors. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. If you are already receiving the STAR credit you do not.

If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. When you become eligible for Enhanced STAR well automatically send you a check for your Enhanced STAR benefit. An existing homeowner who is not receiving the STAR exemption or credit.

Thursday January 3rd 2019 243 PM EST. Exemptions that are offered by Nassau County. RPTL 425 6 a-2 authorizes the department to extend the filing deadline and grant the exemption if it is satisfied that i good cause existed for the failure to file the application by the taxable status date and.

March 1 Deadline to Upgrade to the Enhanced STAR Property Tax Exemption For seniors turning 65 this year the deadline to apply in most localities is March 1. The Enhanced STAR savings amount for. Enter the security code displayed below and then select Continue.

Para asistencia en Espaol llame al 516 571-2020. This form is primarily for use by property owners with Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

However you may be eligible for the Enhanced STAR credit. Enhanced STAR is available to owners of condos houses and co-ops who are 65 with. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Nys enhanced star program online e-sign them and quickly share them without jumping. If No you are NOT ELIGIBLE for the Enhanced STAR exemption off your property tax bill with the Town of Brookhaven. Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and Income Verification Worksheet with the Assessor by the Tuesday March 1st deadline.

Eligibility is based on the combined incomes of all the owners and any owners spouse who resides at the property. The total amount of school taxes owed prior to the STAR exemption is 4000. The following security code is necessary to prevent unauthorized use of this web site.

You currently receive Basic STAR and would like to apply for Enhanced STAR. In this example 1000 is the lowest of the three values from Steps 1 2 and 3. Co-ops Only Management Company.

The dates pertain to assessing units that publish their final assessment rolls on July 1. New requirements for the Enhanced STAR exemption in NYS. If you are using a screen reading program select listen to have the number announced.

Unless directed by the NYS Department of Taxation and Finance existing IVP participants are not required to take. Printing and scanning is no longer the best way to manage documents. Income is defined as federal adjusted gross.

The following security code is necessary to prevent unauthorized use of this web site. WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption in 2019 that they now must enroll in the Income. To be eligible for Basic STAR your income must be 250000 or less.

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. Even if you exceed this limit you are most likely still eligible for Basic STAR.

The STAR exemption program is closed to new applicants. Immediate Wednesday February 09 2022 For press inquiries only contact. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year.

Register with the NYS Tax Department. Burden by taking full advantage of the many property tax. Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year.

January 5 2021. Once the Enhanced STAR Exemption is granted you need not reapply. With the state tax department at wwwtaxnygov.

New York State Department Of Taxation And Finance Facebook

Department Resource Exemptions

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Tax Exemptions Town Of Oyster Bay

Tax Exemptions Town Of Oyster Bay

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Acris Bandwidth Notice Documents Nyc

The School Tax Relief Star Program Faq Ny State Senate

Deadline For Seniors Enhanced Star Exemption In Suffolk Towns Is March 1 Newsday

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times